Momentum & low volatility stock indices can improve your investing outcomes.

Most robo-advisors cheaply and easily invest their clients in a passive diversified basket of index ETFs. Huygens offers you the same ease, but with a better way to invest - both passive and active - using smart beta ETFs.

Smart beta ETFs give you exposure to a broad portfolio of stocks, with each stock’s weighting in the portfolio driven by quantitatively defined indices to enhance aspects of investment performance. Other robo-advisors will typically invest you in capitalization weighted ETFs, which offer attractive fees but can have significant drawbacks.

We use two types of smart beta indices in our ETF portfolios - Momentum and Low Volatility - that for decades have been persistent drivers of better risk-adjusted performance. And we let you choose whether to include only U.S. market exposure, or U.S. plus international.

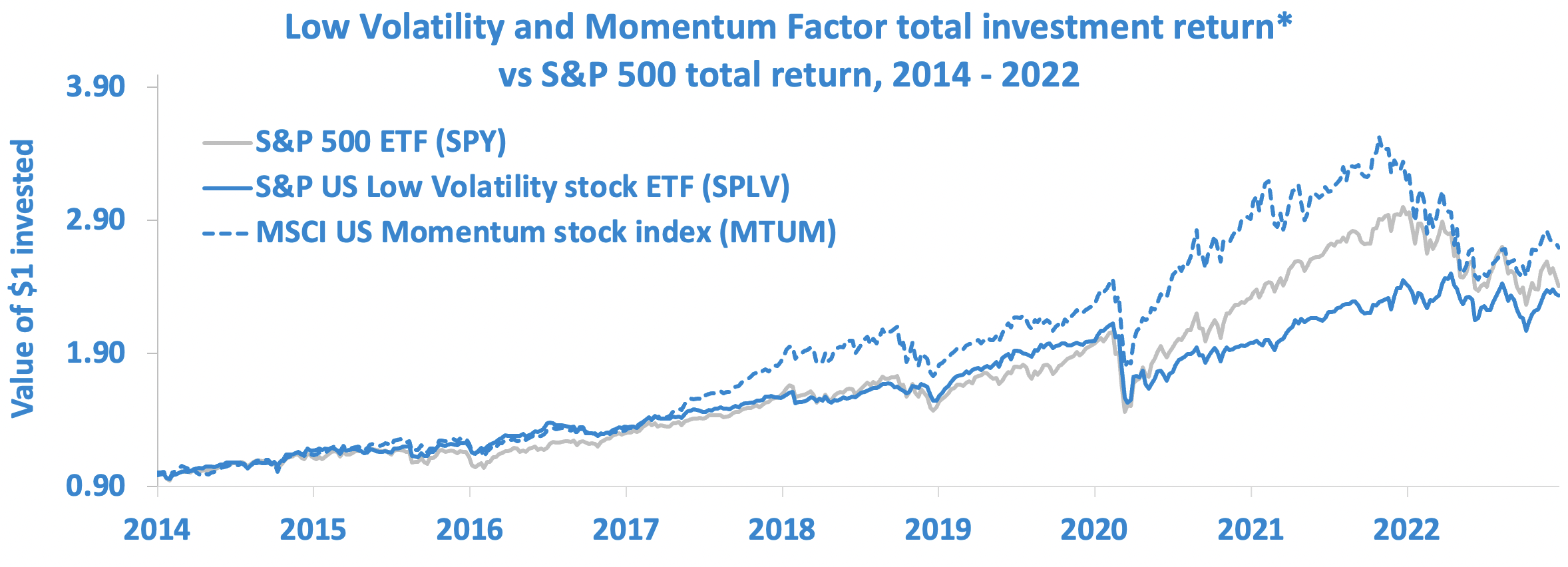

*Total ETF returns net of fees, 2014-2022; Past performance is not necessarily indicative of future results

Low volatility

Similarly, research has also shown that in volatile markets, stocks whose prices have been more stable recently tend to sell off less than the broader market.

We use the following low-volatility index ETFs in our clients’ portfolios to reduce the potential for volatility of returns:

SPLV: Invesco S&P 500 low volatility stock ETF

IDLV: Invesco S&P International developed market low volatility stock ETF

EEMV: iShares MSCI emerging markets minimum volatility stock ETF

Momentum

Substantial research has shown that over many decades, stocks with recent strong price performance have tended to continue that momentum.

We use the following momentum index ETFs in our clients’ passive and active portfolios to enhance potential for higher returns:

MTUM: iShares MSCI USA momentum factor ETF

IMTM: iShares MSCI International momentum factor ETF

See MTUM & SPLV past 10-year price performance relative to the S&P 500 US large cap index →

Equities

Government bonds

U.S.

International

U.S.

International

MTUM: iShares MSCI USA momentum factor ETF

SPLV: Invesco S&P 500 low volatility stock ETF

IMTM: iShares MSCI International momentum factor ETF

IDLV: Invesco S&P International developed market low volatility stock ETF

EEMV: iShares MSCI emerging markets minimum volatility stock ETF

MUB: iShares National municipal bond ETF

VTIP: Vanguard Inflation-protected treasuries ETF

SHY: iShares 1 to 3 year treasuries ETF

BNDX: Vanguard Total International investment grade government bond ETF

EMB: iShares JP Morgan emerging market bond ETF

Optional cap-weighted passive portfolio components

We understand that some of our customers may instead seek the cheapest possible diversified passive ETF portfolio, even if it means giving up the potential for better risk-adjusted performance. For that reason we also offer cap-weighted passive portfolios:

Equities

Government bonds

U.S.

International

U.S.

International

VTI - Vanguard total U.S. stock market ETF

VEA - Vanguard non-U.S. developed markets stocks ETF

VWO - Vanguard emerging markets stocks ETF

MUB: iShares National municipal bond ETF

VTIP: Vanguard Inflation-protected treasuries ETF

SHY: iShares 1 to 3 year treasuries ETF

BNDX: Vanguard Total International investment grade government bond ETF

EMB: iShare JP Morgan emerging market bond ETF