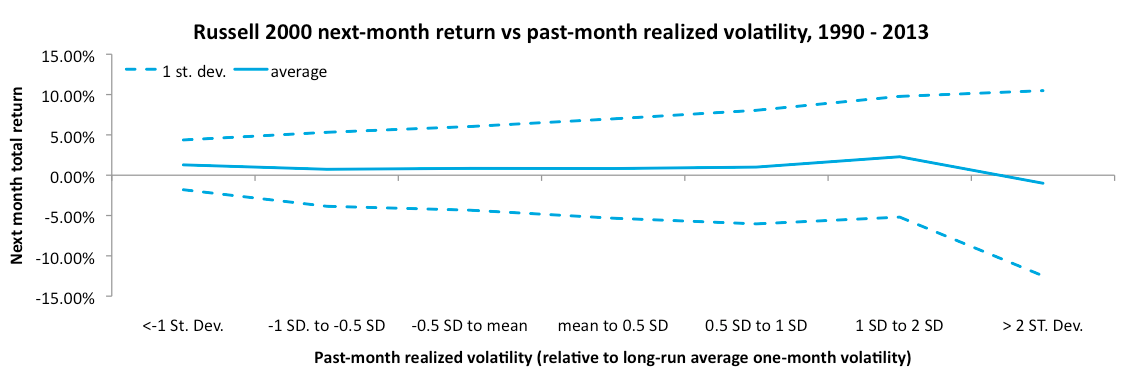

At the end of this month, the taper of the Federal Reserve’s QE3 program is expected to reach the halfway point, with its completion targeted for later this year. Q1 2014 gave us a first glimpse of a return to more normal equity market volatility in response to the taper, with a 7%+ drawdown in the Russell 2000 in each of February and March. Drawdowns of this magnitude are quite common during rising markets; however these recent drawdowns may have felt unsettling because they are steeper than anything experienced in all of 2013. Although it may be tempting to conclude that recent volatility is an indicator of further selling to come, in fact data do not support that conclusion.

The Huygens tactical investing strategies – a brief overview

With this in mind, we believe it would be beneficial to review for you the behavioral finance motivation behind our products, and their design objectives and intended benefits.The below chart (published in the New York Times, March 9, 2013) illustrates that mutual fund investors do not realize anywhere close to the returns of equity indices.The analysis reveals timing as the cause for the disparity – holders of mutual funds as a group make poorly timed decisions to add to or reduce their equity investments.The phenomenon has been widely reported in behavioral finance research, and it arises from two biases in human judgment: first, the tendency of individual investors to fear loss more than to appreciate the opportunity for gain, and second, recency bias, which is an overweighting of recent experience in investors’ decision making.

Analysis source: Dalbar; chart source: New York Times

Jack Schwager, author of the highly regarded Market Wizards series of investing books, recently released the Little Book of Market Wizards. He devotes an entire chapter to downside risk protection, the common trait he has observed among all of the successful investors he has profiled over the years. Downside risk protection can provide enormous benefits in the form of reduced volatility and higher long-term investment returns. Our Navigator decision engine is at the core of all of our products, and its objective is to take human impulses - and errors - out of the risk management decision process. It is designed to participate in rising equity markets while dynamically and systematically hedging against downside risk.

Our research, and past Navigator performance during high volatility periods in 2011 and 2012, have shown that the conditions likely to lead to steep selloffs in U.S. equities can be recognized early in the selloff, in advance of the periods of highest volatility.These predictions are reliable enough that, over time, the benefit of tactically adjusting exposure to equities in response significantly outweighs the cost of potential mistakes.Smaller selloffs and the conditions that lead to them are not so easily predicted, and for that reason our system is designed to “stay the course” during such events, such as those of the past quarter.

The Navigator decision engine is designed to identify “regime changes” in institutional equity investor sentiment. These investors control the majority of capital invested in equity markets, therefore their collective behavior generally determines the prices at which stocks trade. They are also generally limited in their ability to quickly reduce their equity exposure in response to perceived risks: either their portfolio size is such that unwinding exposure would require days or weeks to effect, or their investment mandate explicitly requires them to remain fully invested.

Many of them, however, have the ability to use hedging instruments, such as S&P 500 index put options, to limit their downside risk when they feel it is appropriate. The price they are willing to pay for this protection reveals their current sentiment to the outside world. We exploit these managers’ sentiment changes as they: 1) rotate out of economically sensitive (or “high beta”) stocks and into defensive stocks; 2) become unwilling to deploy new incoming capital into stocks. When this happens en masse during a stock market volatility event, it drives up the price of downside hedges and causes high beta stocks to significantly underperform defensive stocks. Conversely, when their sentiment turns positive, the price of downside hedges falls while high beta stocks outperform. Negative sentiment regimes can last for several weeks, while positive sentiment regimes can last for months or even years.

Our system consists of a focused set of factors designed to recognize certain long-term patterns in the prices of S&P 500 index options that are indicative of current institutional investor sentiment. We then take on either positive or negative exposure to beta with a long or short position in the Russell 2000 index, using either the IWM ETF or the TF futures contract.We use the Russell 2000 index because it has higher beta than any other equity index, and is therefore more sensitive to such sentiment changes. IWM and TF have the added benefit of being two of the most liquid and easily traded equity index instruments, giving our strategies significant capacity and low trade execution cost.