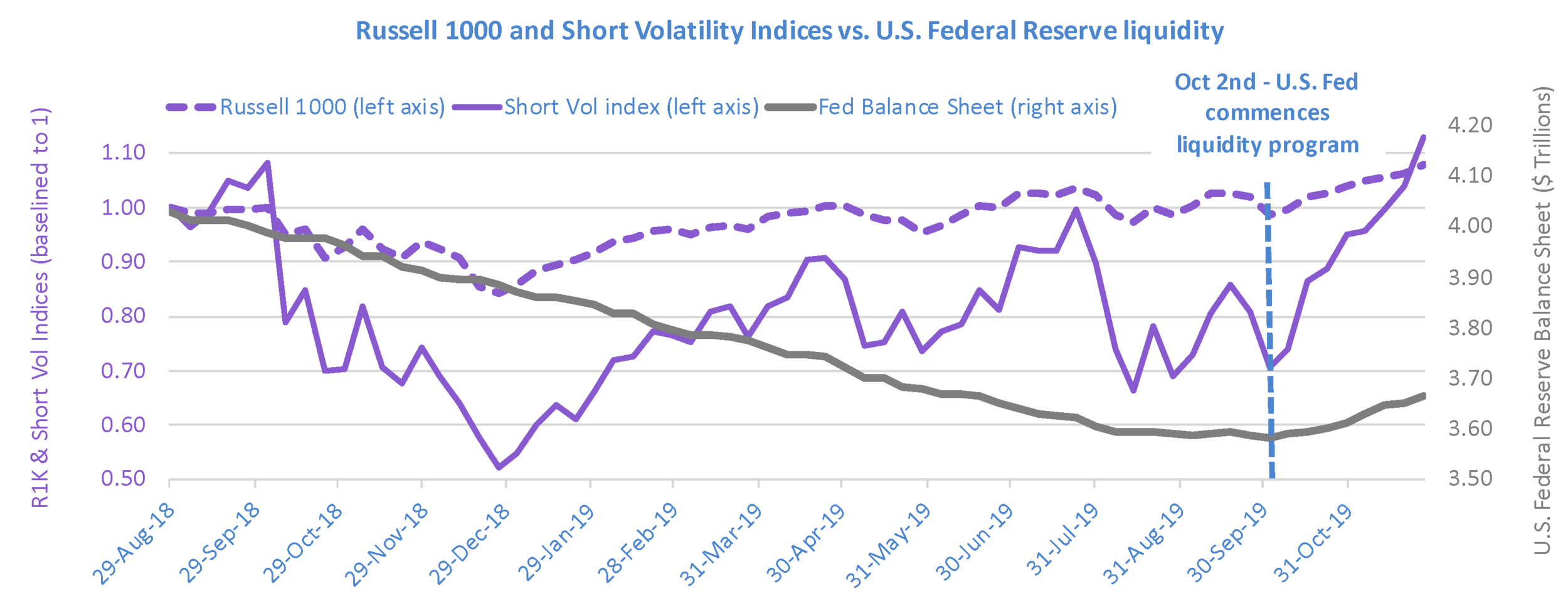

You may recall our analysis (click here to read it) demonstrating that nearly all U.S. stock market gains in the decade 2009 - 2018 occurred during periods of Federal Reserve economic stimulus. Have you noticed that since early October stocks have been on a steady march higher, with the U.S. indices all making new record highs? It’s not a coincidence. The Federal Reserve has begun stimulating the economy again, with a new $60B per month liquidity program launched on Oct 2nd but announced a week later (this New York Times article describes it). They’re not calling it “Quantitative Easing,” but mechanically it is the same, with the same impact on the economy and stocks.

Looking at the chart below, you may be startled to see that despite the very strong run stocks had in 2019 prior to October 2nd, the Russell 1000 stock index was still down 2% from its previous high in August of 2018. Similarly, volatility bursts persisted through 2019, keeping the Short Volatility index from progressing higher. It took this new Fed liquidity to quiet down volatility and enable stocks to push higher.

This program will continue through March of 2020, injecting into the U.S. economy $60 billion or more new liquidity per month. History suggests that investors will benefit.